The head of tax at an accountancy firm with an office in Stamford says the budget

The head of tax at an accountancy firm with an office in Stamford says the budget was broadly in line with what was expected, but savers and those with property or shares will need to look closely at their incomes following the widespread rise. Graeme Hills says it wasn't as radical as feared.

‘Amidst all the speculation and leaks leading up to the Budget, the Chancellor finally stood up in front of the House of Commons and announced what was, in the end, somewhat less sweeping changes as expected or feared. Among one of the wider sweeping changes that was mentioned was the increase in basic high rate and additional rate tax for savings, property and dividend tax by 2%. This is very much still in line with Labour's election pledge not to raise tax on working individuals. But it does still increase tax by 2% for a large proportion of taxpayers. Particularly those with investment properties and investment portfolios, this will have a significant impact on the incomes for those individuals. They need to look at what their ongoing incomes can look like, what the cash flow looks like and also what impact that could have on other people. Obviously tenants with their landlords are having 2% increase on their tax. What will the knock on effect be for those paying rent as well?’

201 bus route affected by road closure in Stamford

201 bus route affected by road closure in Stamford

Road safety improvements on the A43

Road safety improvements on the A43

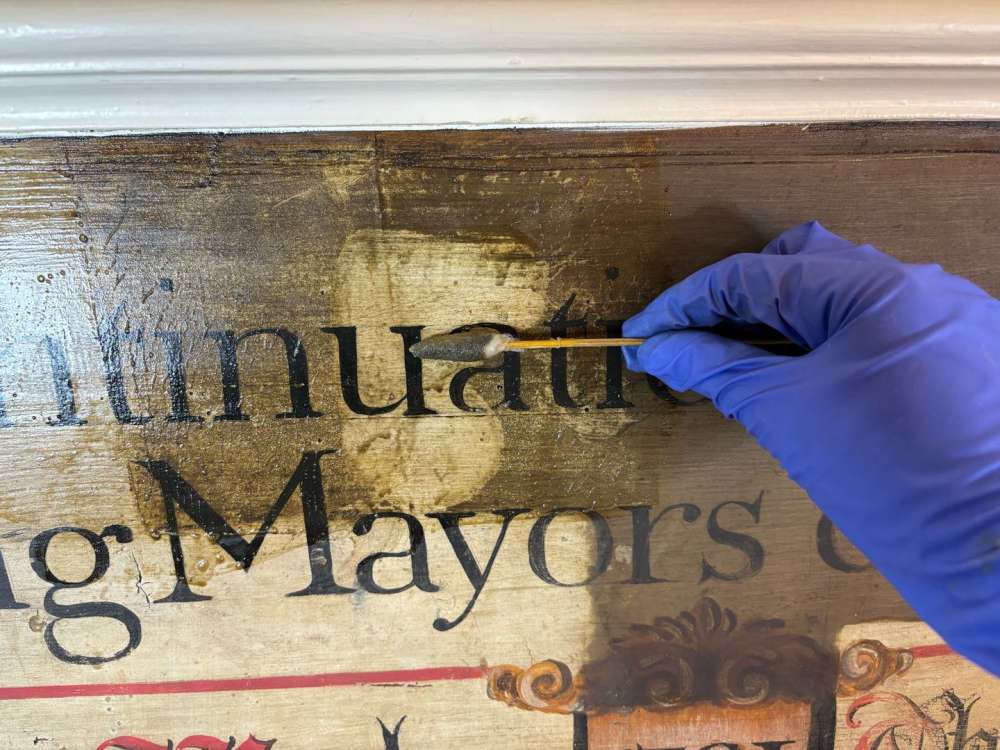

Feasibility study to establish a museum at Stamford Town Hall

Feasibility study to establish a museum at Stamford Town Hall

Seven week consultation now under way for Local Government Reorganisation

Seven week consultation now under way for Local Government Reorganisation

Police officers save man's life in Uppingham

Police officers save man's life in Uppingham

Concerns about several buildings and sites around Stamford

Concerns about several buildings and sites around Stamford

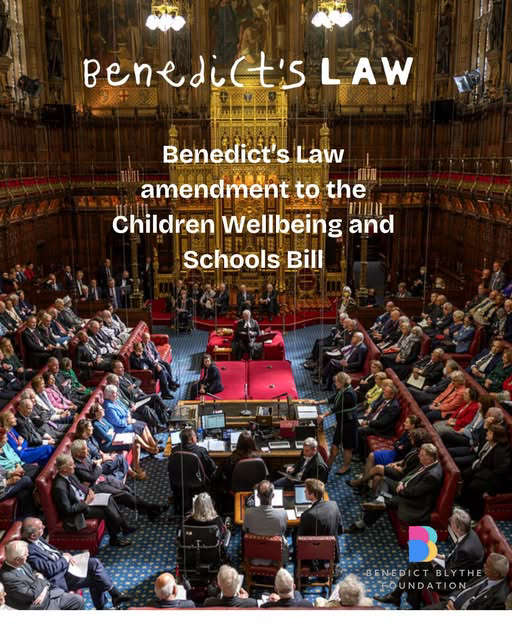

Benedict's Law takes a step forward

Benedict's Law takes a step forward

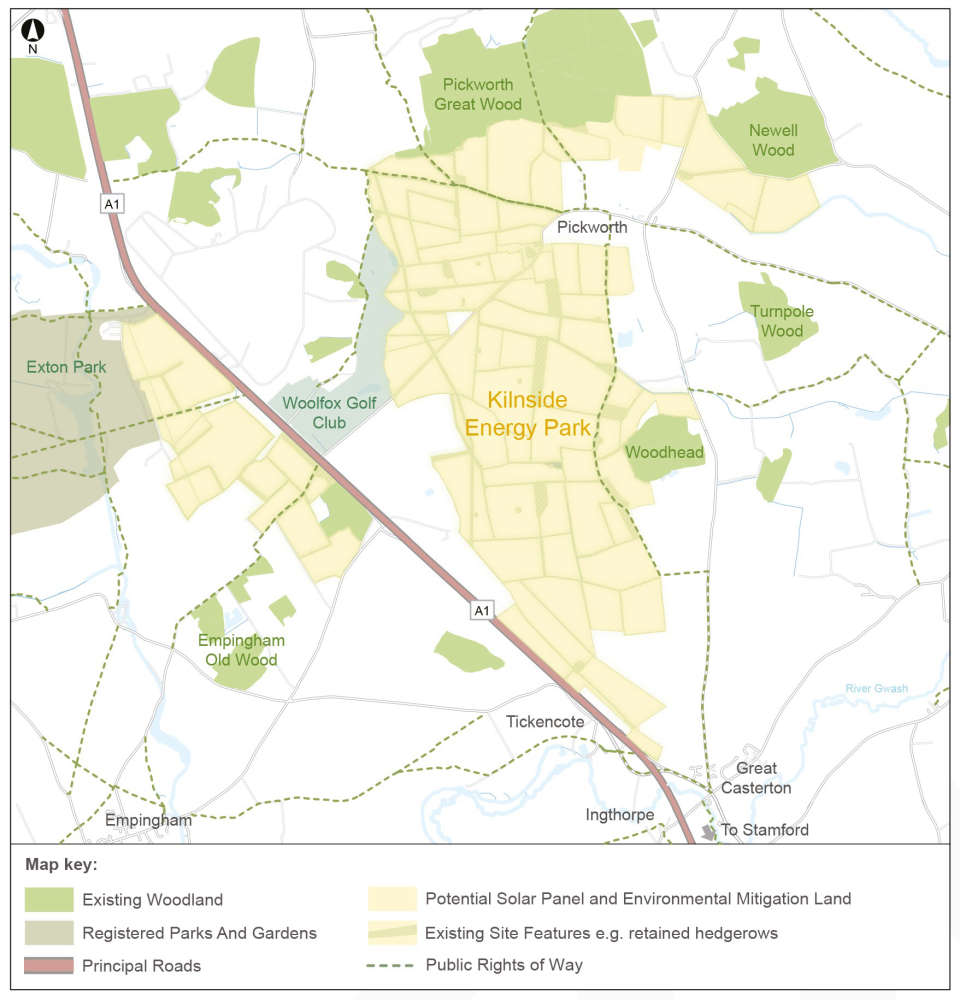

Kilnside Energy Park no longer being developed

Kilnside Energy Park no longer being developed

Police warn of doorstep scam

Police warn of doorstep scam

Benedict's Law to be debated in the House of Lords

Benedict's Law to be debated in the House of Lords

Oakham Library now open

Oakham Library now open

Weekend sports round up

Weekend sports round up